Introduction

Top Forex Trading Platforms for Beginners in 2025 are vital for anyone entering the $7.5T daily forex market. Throughout this guide, we will look at options for beginners, discuss their strengths and weaknesses, important tools to use and tips for making the best choice. Thanks to advanced features now at hand, picking a decent platform gives you more peace of mind when you learn, trade and earn in the evolving Forex market.

Top Forex Trading Platforms for Beginners in 2025

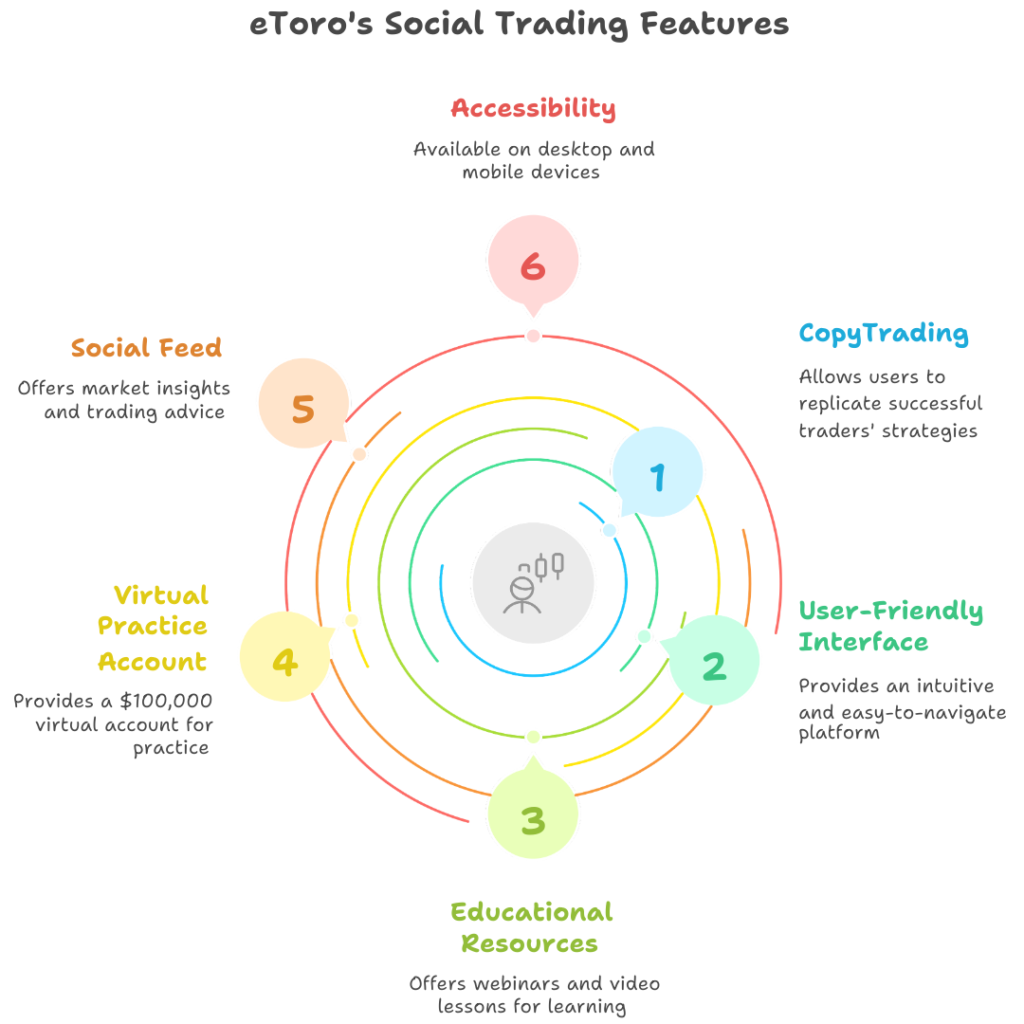

1. eToro

Best for Social Trading

With eToro, beginners enjoy a new way of trading forex through its social features. The trading platform is distinguished for newcomers in 2025 by helping them follow the strategies of successful people.

Key Features:

- It is possible to follow what other traders do in the market by using CopyTrading.

- The main dashboard has a user-friendly interface.

- Using webinars and video lessons forms a part of the training method.

- Use an amount of $100,000 in your virtual practice account.

- To get information on the market and advice for trading, visit the social feed.

- Individuals can use it through their desktop computers or on their phones.

Pros:

- It’s suitable for individuals who like to see the lesson.

- Making forex trades is free; you can only earn money from the spread.

- Individuals who assist each other in trading.

- Many places just ask for a starting deposit of $50.

- Managed by top companies in the finance sector

Cons:

- Its spread can be wider than what other firms may provide.

- There may be fees for taking your money out of cryptocurrencies.

- Acquiring a sponsor is disallowed in particular nations such as the United States.

Why It’s Great for Beginners: eToro is one of the top forex trading platforms for beginners in 2025, is because they are able to fill the knowledge gap by utilizing social trading well. Since new traders can see exactly how experienced traders trade, via risk management, to trading rationales, eToro takes learning from the theoretical to the practical. The clean interface and simple onboarding process also make it easy for forex beginners to get started with trading.

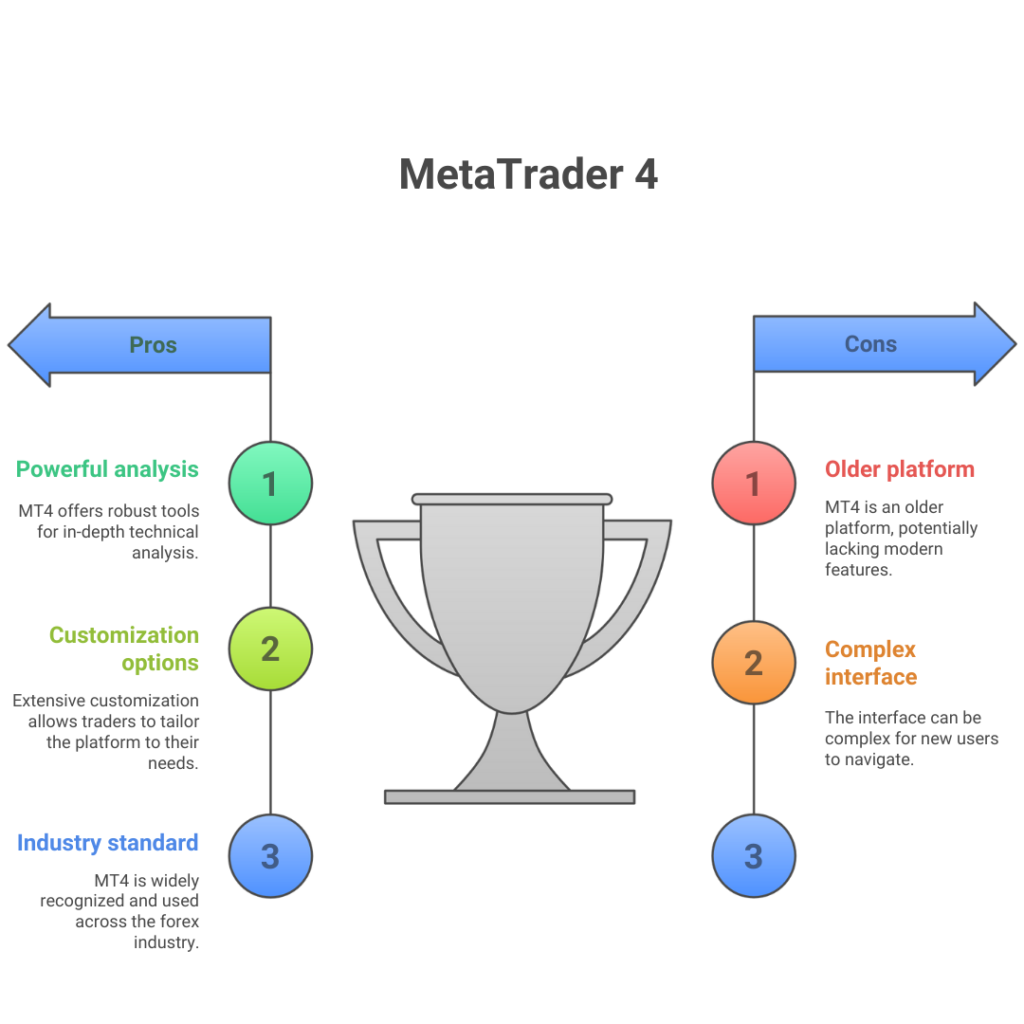

2. MetaTrader 4 (MT4)

Best for Analysis and Customization

MetaTrader 4 remains an industry standard in 2025, earning its place among the top forex trading platforms for beginners 2025 despite being one of the older platforms available. Many traders use MT4 because it is powerful for technical analysis and has several customization options.

Key Features:

- The charts feature 30+ well-known technical indicators.

- It is possible to use custom indicators and Expert Advisors (EAs).

- You can trade with just one click from the charts.

- Different brokers across the globe provide access to it.

- Many time ranges should be reviewed for a complete analysis of the market.

- Mobile trading app with most desktop functionality

Pros:

- This platform is used and backed by the majority of brokers.

- The community provides strong support and resources.

- There is a large collection of custom indicators and automated strategies to choose from.

- It is expected to be steady and up with very little downtime.

- You can use these services free of charge (thanks to brokers)

Cons:

- Modern platforms look more advanced than this one.

- Learning from scratch may involve a quicker learning curve.

- The list of assets is smaller on MT4 than it is on MT5.

- The capabilities depend on the broker you use.

Beginner-Friendly Aspects: MT4 has a reputation for complexity that may scare new traders, but its pervasive presence in the forex scene means that there are extensive learning materials available, from YouTube tutorials to forum debates. A lot of MT4 brokers have put together training material unique to their version of MT4. Its demo account feature offers an unlimited amount of practice time, so it is a great alternative for learning, even if the initial results are overwhelming.

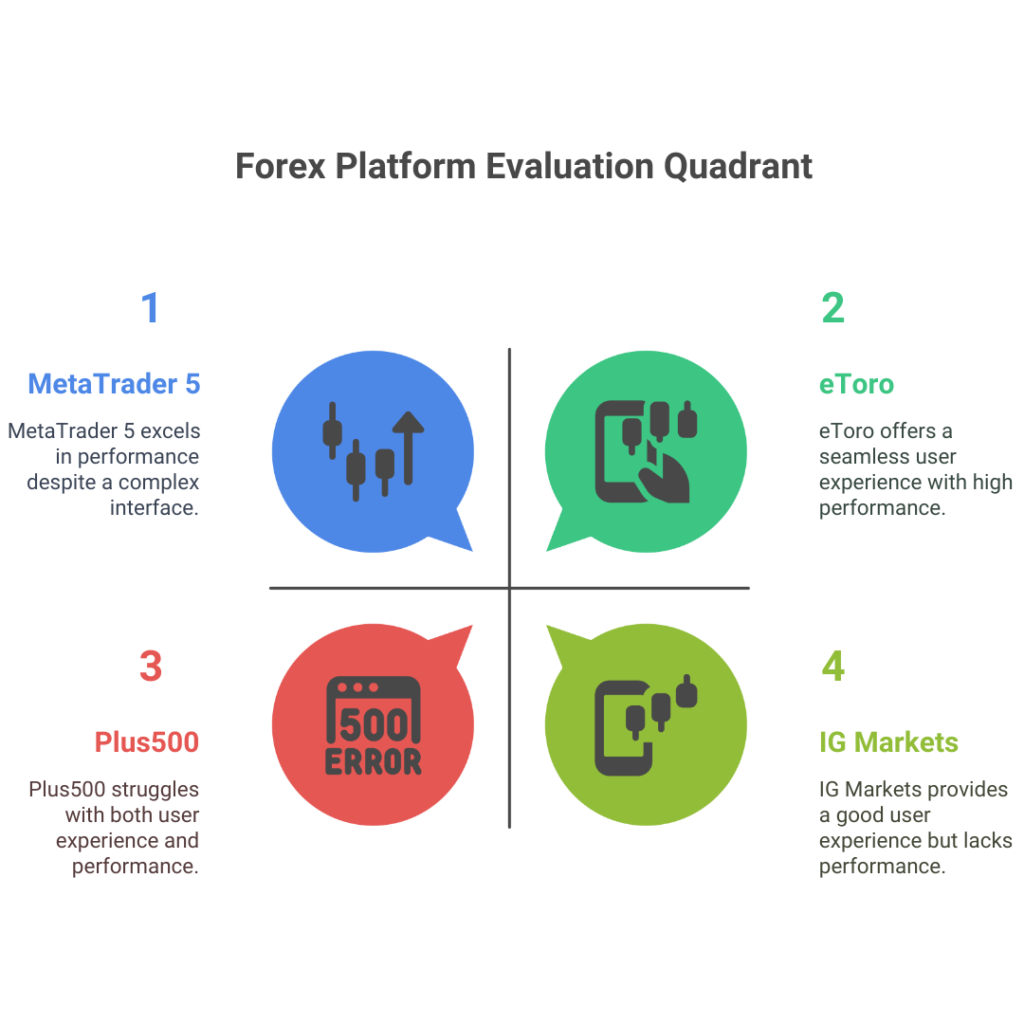

3. MetaTrader 5 (MT5)

Best for Multi-Asset Trading

Top Forex Trading Platforms for Beginners in 2025 MetaTrader 5, the successor of MetaTrader 4, takes its place by improving on the functions apart while keeping even the intuitive functions that brought its predecessor to success.

Key Features:

- More markets to trade, such as stocks, futures, and options.

- Economic calendar integration

- Advanced trading tools with over 38 technical indicators

- Tools and news feeds for fundamental analysis

- Enhanced ability to test historical trades

- 21 timeframes in total (instead of 9 in MetaTrader 4);

Pros:

- Subtotal: More in-depth than MT4 when trading anything diverse

- The Level 3 feature displays open orders

- Works with pending and market orders

- System of netting and hedging accounts

- Multi-threaded testing for faster testing

Cons:

- MT5 has a community that is speedily getting bigger than MT4.

- There are not many third-party EAs and indicators to choose from.

- It can be tough for absolute newcomers.

- Some brokers do not support MT5.

Differences from MT4: Unlike MT4, MT5 offers a wide range of assets, so beginners in forex can easily trade other types of markets once they are ready. With MT5, traders can use a central strategy tester and access advanced types of orders, which helps them progress with more opportunities. Besides being quicker and more powerful, the platform is reliable for the future, although it is not as simple to learn as MT4.

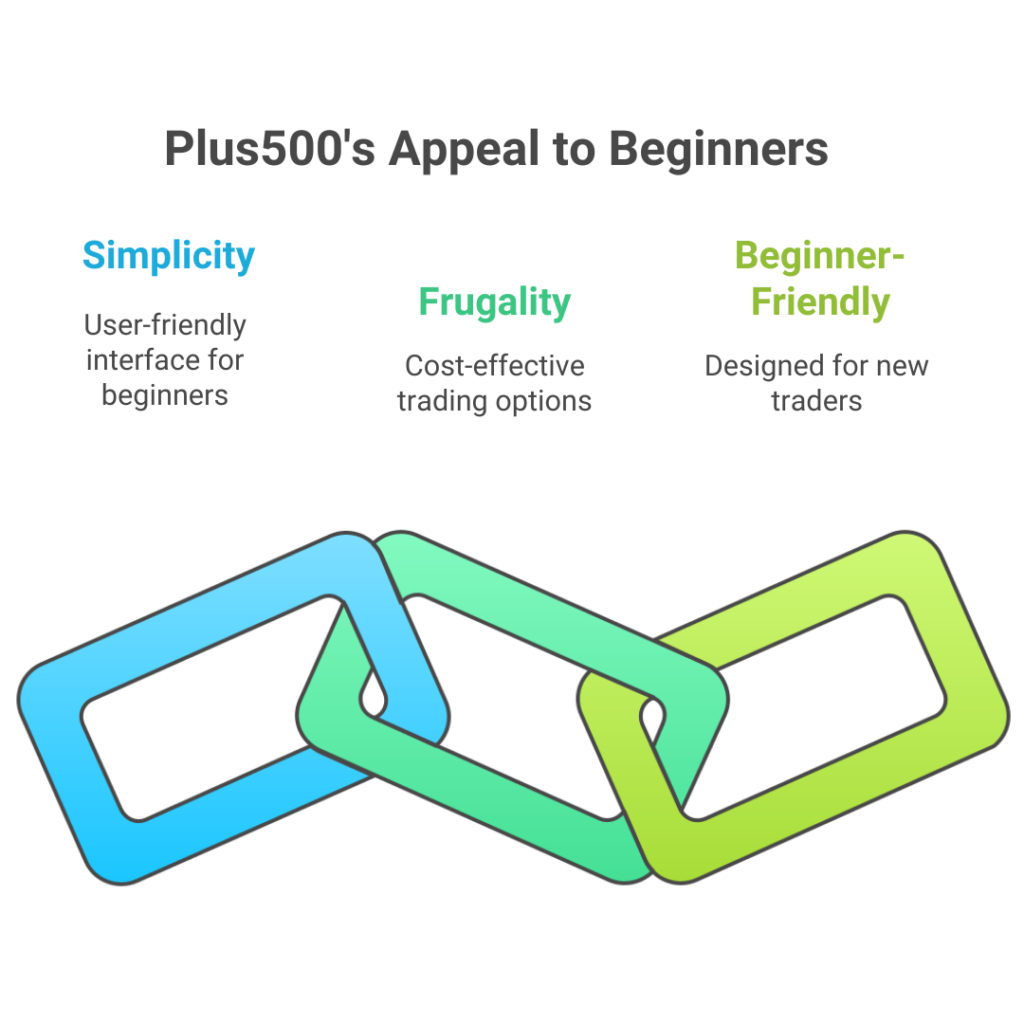

4. Plus500

Best for Low-Cost Trading

Among the top forex trading platforms for beginners in 2025, Plus500 stands apart from others because it is promoted as simple and frugal, which can be especially attractive to those who have only started trading and have limited amounts of money.

- Key Features:

- The designers made the interface user-friendly for beginners.

- Simple charting and analysis tools are included in the proprietary platform.

- Ways to set up stop-loss orders and thus limit your losses

- Real-time alerts are sent and received.

- Protections such as negative balance protection are part of the risk management tools used by the trading platform.

- Quotes on the main currency markets compete at a reasonable level.

Pros:

- Forex trading does not include any commissions.

- Dollars is among the few that allow you to open an account with only $100.

- You can trade unlimitedly for free.

- Account opening is quick and easy.

- The FCA, ASIC, and CySEC are among the organizations that govern it in various countries.

Cons:

- Teachers have fewer resources than professionals in other regions.

- There are no available options for copying other traders’ moves.

- There are fewer customization tools on MetaTrader 4.

- Users are unable to access the markets through direct means (no direct market access).

Cost Efficiency for Beginners: Plus500 does not charge trading commissions, offers tight spreads and keeps costs low for non-trading activities, so it is an affordable broker. You can utilize your live demo account to practice as much as you need until you feel ready to use your own money in investing. One bonus of Plus500 is that there are no surprises with fees for beginner traders.

5. Exness

Best for Low Spreads and Fast Execution

Exness has quickly become popular, not to be left out as one of the best forex trading platforms for newbies in 2025, especially for traders who focus on fast execution and cost-effectiveness.

Key Features:

- Zero-pip spreads are available for US dollar-based major pairs.

- Orders are executed immediately with no delays.

- Make use of various options based on the amount of risk someone is ready to take.

- Clear trade conditions

- You have the choice between different platforms (proprietary, MT4, and MT5).

- Withdrawing crypto instantly is free of any fees.

Pros:

- High performance in situations when volatility is very high

- Trading is very inexpensive here.

- You can start with as little as a $1 deposit (in some cases).

- Support is available at any time in a variety of languages

- Webinars and teaching material are available for those who are just getting started

Cons:

- It is not an option in some places, such as the US.

- Only forex and CFDs are available to trade.

- Highly leveraged trading can be risky for those who have little experience.

- Few research options compared to some of the top competitors.

Why It’s Ideal for New Traders: Exness is attractive to beginners because it eliminates two main inconveniences: setting up can be expensive, and trading can be unpredictable. Because the platform discloses the rules of trading, even newcomers are reassured by its practices. Micro-lot accounts available to new traders ensure that everybody enjoys the same speed, reliable service, and assistance on the forex market from the start.

6. IG Markets

Best for Education and Research

IG Markets is the top forex trading platform for beginners in 2025 for several reasons, such as the company’s unique dedication to ideas and thorough research of the market.

Key Features:

- A recognized platform that is simple to use.

- A broad-based academy that offers arranged courses.

- Ability to use advanced charts with ProRealTime support.

- High-quality analysis and market study.

- You can trade in more than 17,000 markets and 80+ forex pairs.

- Three different platforms to choose from (proprietary, MT4, ProRealTime).

Pros:

- Resources are categorized by how knowledgeable each person is

- Frequent webinars and seminars are presented by experts in the market

- Registered with a solid history of tier-1 licenses

- The product stands strong amidst changes in the market

- Having 24/5 customer service is excellent.

Cons:

- Requires a minimum deposit of $250 when opening an account.

- Weekends are associated with an increase in trading spreads.

- The drug is not permitted in every nation, including America.

- It may feel challenging for people just starting.

Global Market Access: Through IG Markets, new traders are able to trade in over 80 types of currency pairs and several financial instruments available on a global scale. New traders can learn how various changes in the forex market happen due to factors in other parts of the world. At the start, the platform discusses leading movements in currency trading, and users can develop their expertise by taking courses at the academy.

7. AvaTrade

Best for Versatile Trading Options

Discussing the top forex trading platform for beginners in 2025, we included AvaTrade, which provides beginners with the outstanding flexibility to deal with forex trading.

Key Features:

- You are offered MT4, MT5, as well as our own AvaTradeGO app (proprietary desktop and iOS apps).

- Support for using automated trading strategies

- Using the risk management tool from AvaProtect

- This center provides various videos and electronic books for education.

- Using the trading analysis and signals provided by Trading Central

- There is an account with $100,000 for testing purposes.

Pros:

- All over the world, countries regulate finance.

- You will not have to pay any commissions when trading forex.

- Competitive rates on the main currency groups

- Many types of trading tools and indicators are available.

- A great way to trade on your mobile device

Cons:

- In some cases, inactivity fees are charged for not using your account for a long time.

- A smaller range of available cryptocurrencies is offered compared to those on specialist sites.

- Some of the more advanced options include extra signups.

- Compared to others, this broker requires a higher minimum deposit ($100).

Support for Automated Trading: AvaTrade is incredibly suitable for neophytes who want access to automatic trading strategies; this is where it mostly excels. The platform is designed to support many types of automation solutions, such as DupliTrade and ZuluTrade, along with the usual MT4/MT5 Expert Advisors. This multi-functionality feature empowers novice traders to experience a gradual and personal journey towards automation. Spy, who is a spy? Through one of the following ways: copy trading, semi-automated signals, or fully automated algorithms. The platform’s educational resources also comprise resources that teach the best practices for automation, ensuring that beginners are not left to get lost navigating this part of trading a systematic path.

How to Choose the Right Forex Platform for You

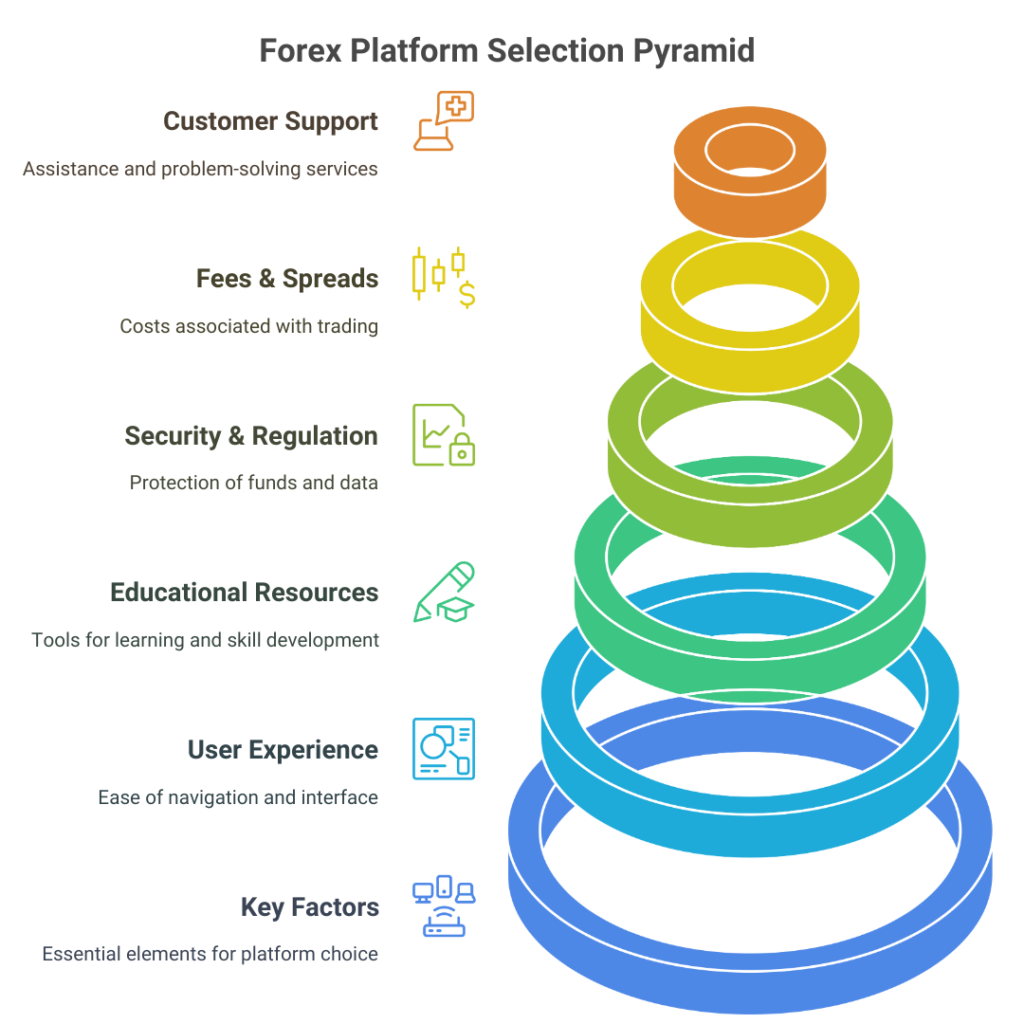

While the selection of the top forex trading platform for beginners in 2025 is the most important factor in having successful trading, with lots of amazing choices available, it implies cautious consideration of several key factors:

User Experience

The platform’s interface and overall user experience can considerably affect your learning curve and trading efficiency. Keep in mind:

- Intuitiveness: Is the platform easy to use without having to consult guides frequently?

- Visual clarity: Are the charts and order panels well-arranged and customizable?

- Accessibility: Can you access the platform from your chosen devices (desktop, mobile, tablet)?

- Performance: Is the platform working fine on your hardware, even with multiple charts open?

Platforms for beginners must be simple, clean, and at the same time introduce complexity as the trader’s experience grows. On the one hand, the platform meets the user’s needs. The user’s preferences can be checked with a demo account to make sure that real money is not thrown away weakly.

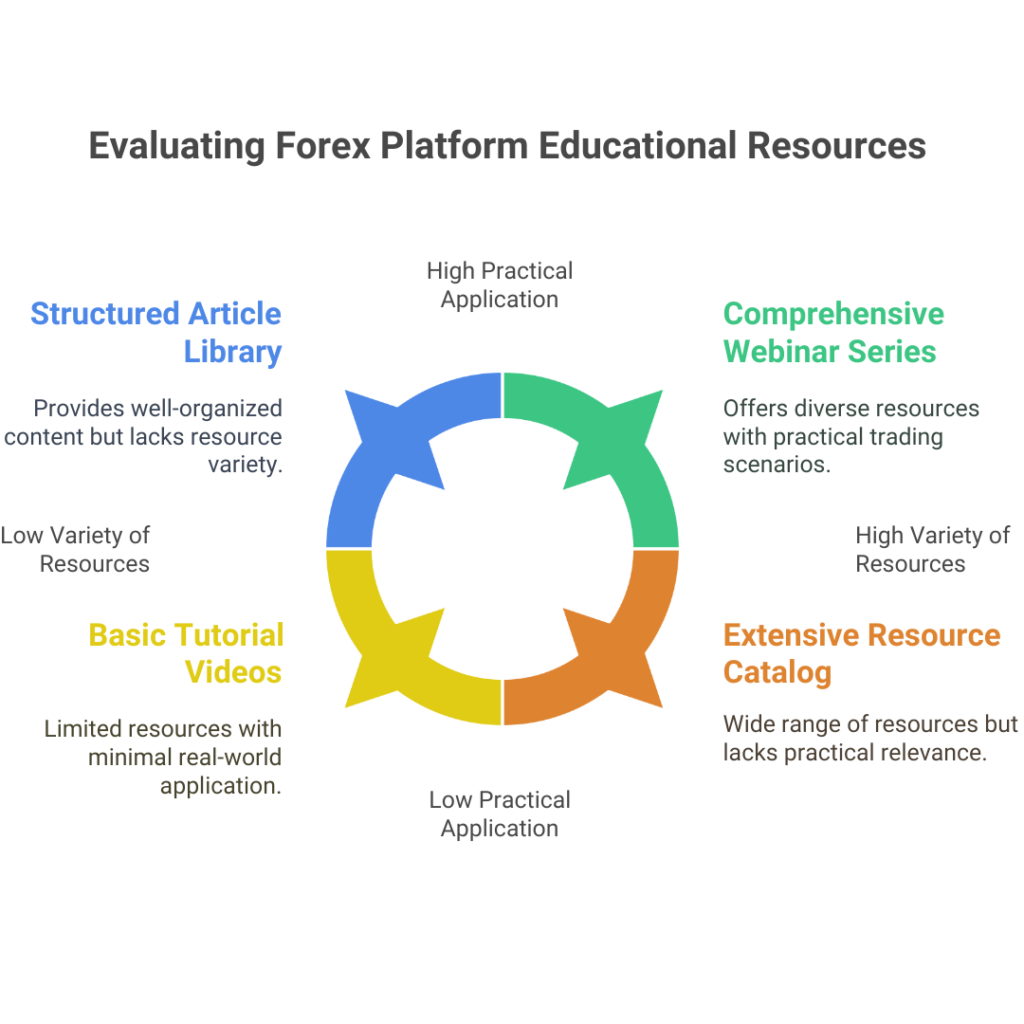

Educational Resources

Having access to the highest quality educational material can result in significant growth as a currency trader in a short period. Determine platforms by what they can offer you in the following areas:

- Variety of resources: The more media options does the website provide such as videos, articles, webinars, and courses?

- Content structure: Are resources ordered in a step-by-step manner, starting from the simplest to the complex topics?

- Operations in real life: Are the educational resources practical? Do they describe trading situations using the theoretical concepts taught?

- Continuous learning: Does the platform inform users regularly, and does it have the provision for updated market analysis?

The use of rightly guided platforms for novices is a pretty good start for their early learning. It will involve a series of conversations about the basics of the trading process, illustrated with examples from the market, and will lead you through the process of finding opportunities and the impact of the market in real time.

Security and Regulation

It is the very basic fact that your money and personal details must be protected securely. What you need to check are:

- Legal regulations: Does the platform respectfully participate in the supervision of financial markets by some official bodies?

- Separate accounts: Are the company’s funds kept in separate accounts from those of the client?

- Insurance compensation: Is there a deposit insurance, meaning that the funds of clients will be safe if the broker becomes insolvent?

- Security tools: Is the application safe with no third-party access, two-factor authentication, and other safety precautions?

Beginners should be extra vigilant with the platforms offering high leverage ratios or attractive bonuses, as these may be signs of low-quality services.

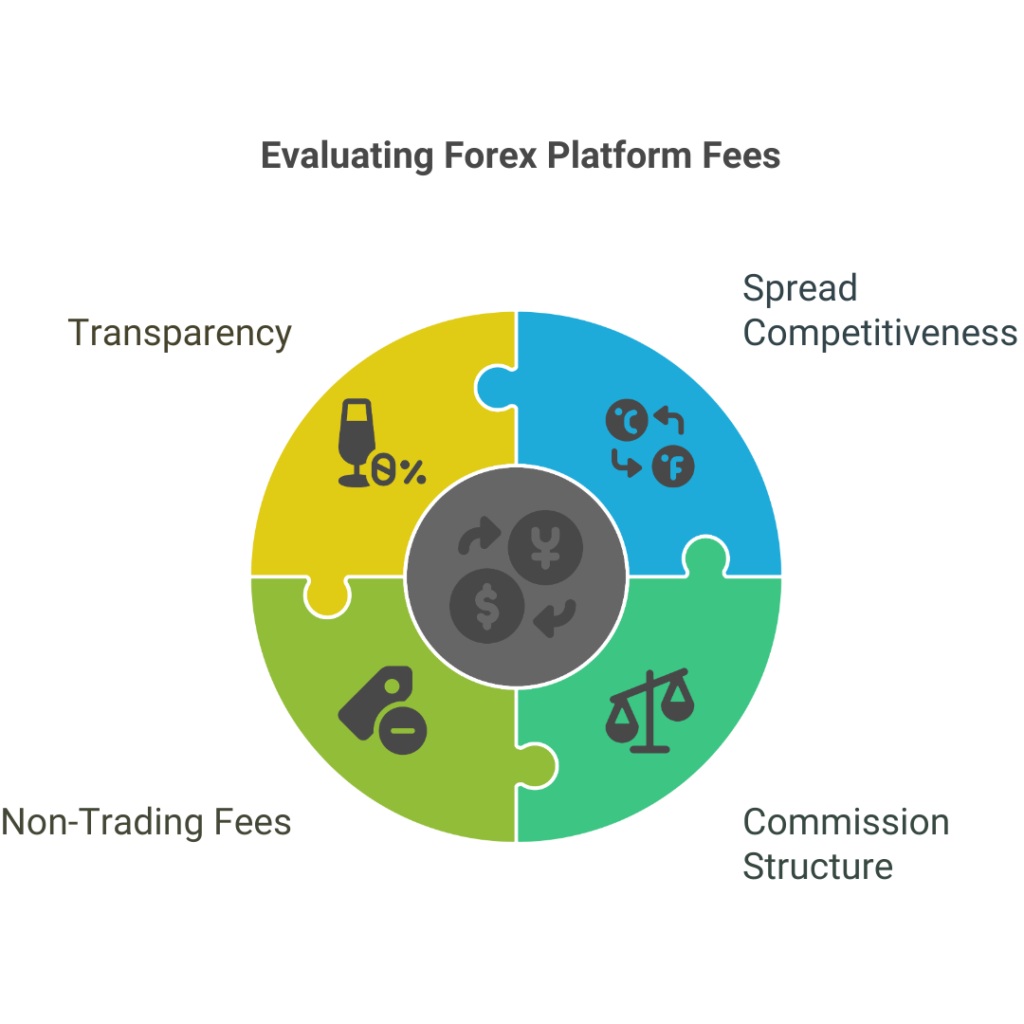

Fees and Spreads

The money one uses to trade can make a big difference in the profit they get, especially if they are just beginners starting with a lower amount of money. Gain a deeper insight by comparing:

- How does the spread competitiveness look on major pairs across the various platforms?-

- Commission structure: Does the platform charge fixed commissions or operate on a spread-only model?

- Non-trading fees: Are there charges for deposits, withdrawals, inactivity, or account maintenance?

- Transparency: Is the fee structure clearly explained without hidden costs?

Indeed, the costs involved in the process should not be the only factor in deciding, but one should still be cautious of the additional fees that can eat into their trading capital over time. Beginners will find lower-fee platforms that offer competitive spreads and minimal other fees as a better choice for them.

Customer Support

The first-time trader in foreign exchange often faces the most difficult period, and that is where they need the most responsive and intelligent assistance. Analyze:

- Availability: Does the support work 24 hours from Monday to Friday and is it possible to get limited coverage?

- Access channels: Can you reach support through chat, email, phone, and social media?

- Response quality: Do support staff provide helpful, accurate information rather than only generic responses?

- Language options: Is support available in your preferred language?

Prior to opening a paid account on the brokerage, find out if the platform’s customer service has been tested by inquiring about the trading conditions and the account features and checking the timeliness and response quality of the received answers.

FAQs

How much money do I need to start Forex trading?

The lowest deposit that you will be able to use for the best forex trading platforms for beginner traders in 2025 is very different:

- eToro: $50-$200 depending on your region

- MetaTrader 4/5: Varies by broker, typically $5-$200

- Plus500: $100

- Exness: As low as $1 for some account types

- IG Markets: $250

- AvaTrade: $100

However, the majority of the professionals in the industry advise a minimum of $500-$1,000 to be safer with the profit and loss effects of trades. With lower amounts, the trades that are even well-thought-out and have the correct risk levels may become untenable due to the requirements of the size of the position that need to be met.

A lot of trading platforms provide micro or nano lot trading, which permits new traders to make a profit with very little money. That being said, ensure that the account balance is sufficient to cope with the normal fluctuations of the market, since small accounts provide almost no space for them besides the trading strategies that are guaranteed to exist.

Are demo accounts important for beginners?

There are multiple reasons why beginners cannot do without demo accounts:

- Risk-free practice: Determine the features of the platform and improve trading skills without risking any money.

- Strategy testing: Test out different trading strategies to find those that suit your character the best.

- Emotional management: Learn and deal with the psychological challenges of trading before the case with real money.

- Platform evaluation: Try out various platforms and compare their user experience to see which one fits you best.

According to the top forex trading platform for beginners in 2025, more or less all of them offer unlimited demo accounts or an extended trial period. The idea is that beginners practice on a demo account for 1-3 months before they start real trading. Moreover, many traders of this type still trade with both demo and live accounts to test out fresh strategies.

Which platform has the best educational resources?

While all the platforms on our list have some knowledge base in their libraries, three platforms have caught our special attention with their rich educational programs:

- IG Markets: This broker offers a truly one-of-a-kind structured educational academy, which provides the possibilities of learning from a complete novice to a professional trader. They have interactive lessons, webinars, as well as very detailed strategy guides at their disposal. The resources are excellent.

- eToro: By focusing more on the practical aspect of education, the platform makes use of social trading features to allow inexperienced traders the chance to learn simply by observing the performances of pro traders and their risk management strategies.

- AvaTrade: eBooks and video content are AvaTrade’s strong points, especially providing the beginner with a clear explanation of the essential technical analysis concepts through the video format.

The “best” educational resources are, to an extent, based on your way of learning – for example, visual learners could be more attracted to AvaTrade’s video-rich method, while eToro’s community feature could be beneficial for the social ones.

What are the best mobile Forex trading platforms?

For traders who prefer to trade on their devices, these platforms provide the best mobile tools among the top forex trading platforms for beginners.

- The eToro app is very easy to use and has most of the same functions available on its website.

- You can use the Plus500 app on a phone and find it simple and easy to operate, even with limited space.

- AvaTradeGO enables mobile dealers to trade with unique features, such as having the AvaProtect risk management tool and support for swing trades.

In addition to appearance, consideration should be given to how fast it runs, how the charts function, how secure trading is, and how you can control your account from your device. Most companies allow users to practice mobile functions with a demo account through their mobile apps.

Conclusion

Selecting the right platform from among the top forex trading platforms for beginners in 2025 represents a crucial first step in your trading journey. The main characteristics of the listed companies include social trading at eToro, thorough analysis with MetaTrader, trading with Plus500, top execution at Exness, educational materials at IG Markets, and various choices at AvaTrade.

You need to choose the program that suits your studying preferences, budget, and trading goals. Create several practice accounts and examine the available training materials to become familiar with the fee structure.

Cracking the experts’ level often takes a lot of time spent training on Replit. It’s better to read about the process first and then enter forex trading. Whenever you gain more knowledge about forex trading, you are helping yourself succeed over time.

During the following year, join Forex platforms designed for new traders, test things out on demos, and use any knowledge blogs offered to pick the best one. Choose the best platform for learning and become comfortable using it.

Read more articles-