Trump Tariffs: The reintroduction of Trump tariffs created a worldwide economic controversy that cannot be dismissed. President Donald Trump announced his remarkable trade policy on April 3, 2025, which generated worldwide shockwaves that impacted both financial institutions and global food retail markets. The New York Times reports that Trump declared a 10 percent trade barrier on global imports and imposed a 34 percent tax on Chinese products, which produced an unexpected economic earthquake that transformed international commerce in a single day. After Trump’s trade policy announcement, the S&P 500 suffered its biggest fall since June 2020 at nearly 5 percent in a few hours, according to The New York Times, which stated this was starting a possible worldwide trade conflict. Asian markets joined the panic as the Nikkei in Japan suffered almost two percent decline while the Kospi in South Korea dropped by one percent on Friday morning.

Every day, American citizens experience direct consequences from this event. According to The New York Times, grocery prices are expected to rise by late April while businesses fight to change operations and governments worldwide rush to resolve the situation. The sweeping policy shift produces direct consequences that hit both financial assets and employment opportunities, and diplomatic ties of nations all over the world. So, what’s driving it? The application of tariffs brings fundamental changes to our reality while altering economic standards. Which set of policies does Trump currently execute through this strategy? Is there any way to determine who must cover the expenses of tariffs as the payment date approaches? Trump has shown such an intense desire for tariffs that it leads to several important questions. The following comprehensive review explains everything related to Donald Trump’s tariffs and their market disturbance and Canada’s tensions with Trump regarding Trudeau and Ford. Here you will find the complete account of the trade reckoning during 2025, which covers investment tracking and impact on costs along with Trump tariff details.

Section 1: What Are Tariffs and How Do They Work?

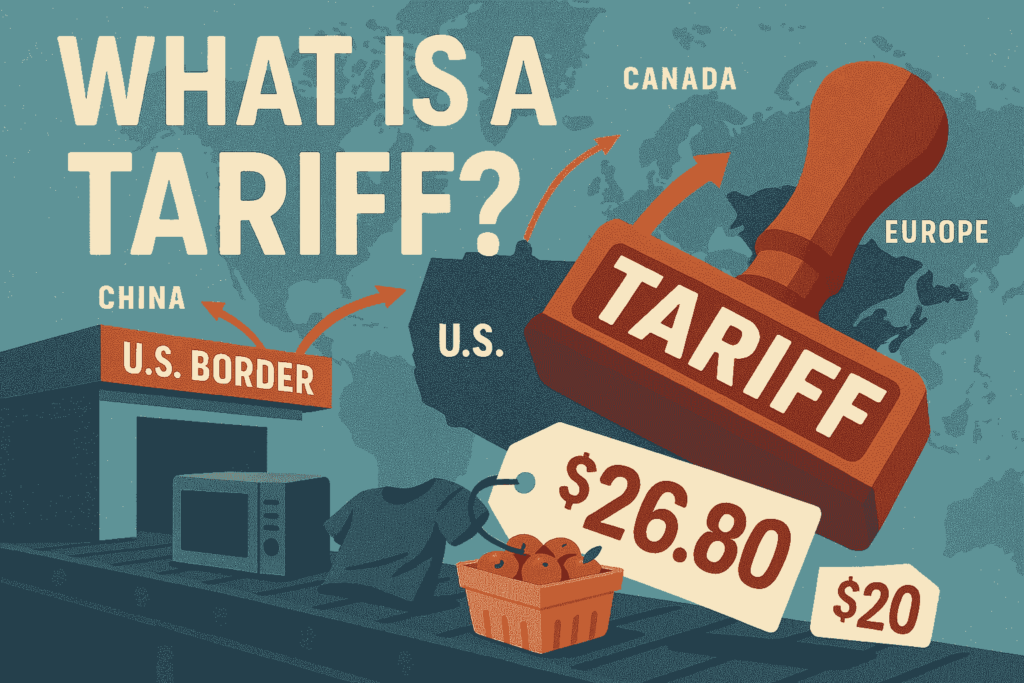

At the foundation, we need to understand what defines a tariff as a tax governments impose on imported goods that enter their border limits. A government implements tariffs when it imposes taxation on products that try to enter its borders. International importers of Vietnamese sneakers and Mexican oranges need to pay fees to enter U.S. stores based either on product value or quantity before the products reach U.S. shops. The tax system known as tariffs existed for centuries and sustained entire governments, as demonstrated by 1800’s America, when it protected local competitors against foreign competition. Modern trade conflicts reveal tariffs as powerful instruments employed by the Trump administration through actual tariff implementations.

So, how do tariffs work? It’s a domino effect. Picture a $20 pair of headphones from China. The importer covers $6.80 in additional fees to U.S. Customs when they pay the 34 percent Trump-related tariffs, as reported by The New York Times. Post-importation options include either passing the new $26.80 price tag to customers or losing profits by absorbing it. The seller may also try to source the product from a U.S. supplier if possible. The choice of price adjustments is distributed across various possible solutions based on product type and market competition. The goal? Foreign products will have increased prices to steer consumers toward American products.

This isn’t theory—it’s happening now. In April 2025, Trump implemented tariffs that imposed 10 percent taxes on imports from Japan, the EU, and Canada and 34 percent duties on Chinese electronic products and clothing, according to The New York Times. The policy serves as an exaggerated apparatus to alter trade balance yet fails to create sole disadvantages. According to The New York Times, China has initiated a 34 percent tariff increase on U.S. exports, while further countries might take similar retaliatory measures. Business success resembles a game of chess since each decision affects product costs, supply networks, and market control systems.

History adds context. During the 19th century, U.S. industry developed through using tariff payments which generated 90 percent of federal revenue in 1800. Freedom of trade became the main principle, yet defensive economic policies maintained their permanent role. Trump stands behind this traditional approach because he believes it will bring new life to the country, which has been devastated by globalization. This essay examines whether the protectionist plan put forward by Trump will fail or disintegrate completely.

Section 2: What Are Trump’s Policies on Tariffs?

We must understand Trump’s policies to understand Trump’s tariffs properly. Since 2016, Trump has devoted his attention to trade matters by criticizing “horrible deals” that drained American job opportunities. His first presidential year began with steel and aluminum import duties combined with Chinese trade barriers that he presented as benefits for middle-class citizens while targeting international business leaders. Now, in 2025, he’s gone bigger. The New York Times publication details how on April 3, Trump delivered a speech to the nation about his newly enforced tariffs of 10 percent for all imports and 34 percent for Chinese merchandise as he sought to end “unfair trade practices” that stripped industrial activities from America’s manufacturing zones.

The scope’s staggering. The New York Times highlights that Trump’s staff eliminated the de minimis rule permitting Shein, alongside other e-commerce giants, to send their cheap packages (under $800) tax-free. Any item worth $15 or less and all things priced at $5 or below are now subject to taxation. This import blockade builds a direct assault on international trade for the goal of resurrecting American manufacturing activity. Most supporters admire it as innovative brilliance however, detractors have warned through The New York Times that this measure risks causing a destructive economic fire.

Trump supports tariffs due to what? His rational argument goes as follows: job protection leads to deficit reduction, which enables the funding of his blueprint. The United States incurred a $500 billion trade deficit with China during 2023, which Trump considers outright theft instead of standard business dealings. In his view, tariffs create a fundamental shift in which imports become less desirable and factory facilities move into U.S. territory. In April, he declared to the New York Times that his goal was to create unparalleled economic growth. The steel mills’ operation and auto factories’ production, combined with employment growth, create a vision perceived by President Trump that tariff revenue enables.

Contrary to popular belief the Donald Trump tariffs, produced a different effect on stock market performance. Investors’ panic triggered a 4.8 percent drop in the S&P 500 stock index on April 3, according to the New York Times analysis. Trump dismisses these trade issues as transitory market disruptions, though historical evidence does not demand the same interpretation. Several academic studies documented that steel jobs grew slightly (1-2 percent) during 2018 following Trump’s tariff implementation, although the prices increased and reciprocal trade measures were triggered. The current round of measures surpasses past measures by size while presenting amplified levels of danger.

Section 3: The Trump Tariffs List—What’s Being Hit?

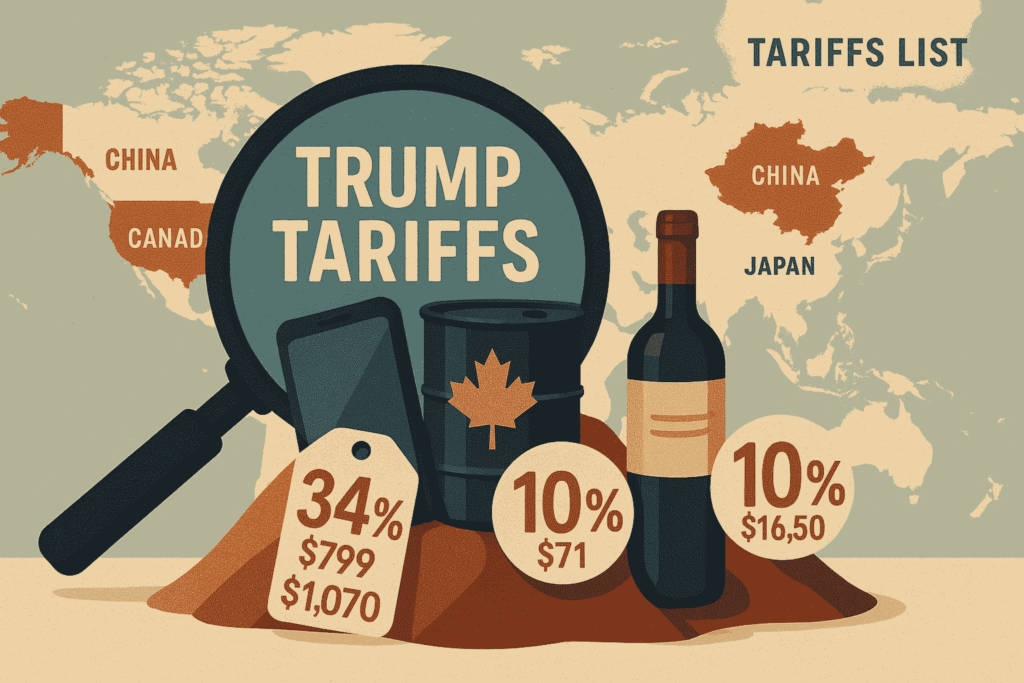

Specific details show the Trump tariffs, will begin in April 2025. The New York Times delivered the essential information about Trump’s announcement, which continues to transform daily, although this is what we have documented from his proclamation:

The United States implements 10% import duties affecting products entering from most countries including automobile, technology goods from Japan and wine, machinery from the EU along with Canadian oil and lumber. Tariffs deploy against all major partners in the world today.

The United States is set to implement a 34 percent tariff against Chinese products which may strike various items from smartphones down to laptops and clothing, together with toys bearing the “Made in China” tag. Mississippi County has yet to specify its complete targets.

Amazon and other retailers must now pay taxes on small online shipments less than $20 because the e-commerce loophole has expired according to The New York Times.

The real-time processing mechanism behind tariffs occurs in this manner. A $50 Chinese jacket? Shippers need to add $17 to Chinese tariffed products before reaching the $67 price mark. The application of 10 percent duties applies equivalently to Canadian car parts alongside German wine bottles. Same deal—costs climb. Confirmed by the New York Times analysis, the change is coming soon to food shelves across America since imported foods such as avocados and bananas will face 10-20 cent price hikes per pound starting in late April. It’s not a maybe; it’s math.

The Canadian trade situation serves as a key point in this situation, which links Canada and US tariffs together along with their leaders Trudeau and Ford, and Trump. The New York Times reports the top U.S. trade partner faces the current 10 percent tax without any product exceptions. The upcoming article will demonstrate in detail how this decision massively impacts both oil industries and car manufacturers and other industries. The documented list remains dynamic because of ongoing discussions and court battles (according to The New York Times) alongside international opposition.

Section 4: Who Pays Tariffs and Feels the Impact?

As per legal standards, the responsibility to pay tariffs rests with importers who import goods into the United States. Under legal terms, the company that handles goods imports to the U.S. serves as the entity responsible for payments. The $1,000 Chinese electronics imports now need to pay $340 in Customs fees, according to The New York Times report. But that’s step one. The price burden from tariffs can trigger businesses to absorb the financial loss by reducing profits or to pass the cost onto customers through higher prices, while triggering replacement of suppliers in the distribution network. Official studies of Trump’s first term in office validate that consumer prices absorb 80 to 90 percent of trade levies, with importers typically passing costs throughout their customer base.

Ground it in reality. The New York Times forecasts that the $340 Customs tax implemented in April 2025 will lead Target to increase prices on its $10 gadgets up to $13. Modernizing the size of your typical consumer products will trigger your budget to suffer under increased costs. The upcoming grocery inflation will heavily impact basic products through a 10 percent price increase on coffee and fruits. This economic data requires no fear-based rhetoric because it represents standard financial principles.

The stock market reaction to Donald Trump’s tariffs illustrates the situation best. The S&P 500 experienced a 4.8 percent market crash on April 3, according to The New York Times, reporting that investors feared that Apple and Ford would be impacted by Chinese counter-tariffs that could reduce their sales. Financial investors withdrew their funds from Treasury bonds to seek protection in Treasury bonds, according to The New York Times, which caused interest rates to decrease. The Nikkei stock exchange lost 2 percent worldwide while Kospi reached over 1 percent down as evidence shows a broad international impact.

Retaliation’s the sting. China enacted a 34 percent tax increase affecting U.S. exports, which includes soybeans alongside automobiles, along with whiskey products as per The New York Times report. The emerging market decline for Iowa farmers as well as Michigan autoworkers can happen swiftly. Companies start a reaction chain when Trump implements tariffs, while all affected parties, including consumers and businesses, and employees, end up bearing the costs.

Section 5: Canada-US Tariffs: Trudeau, Ford, and Trump

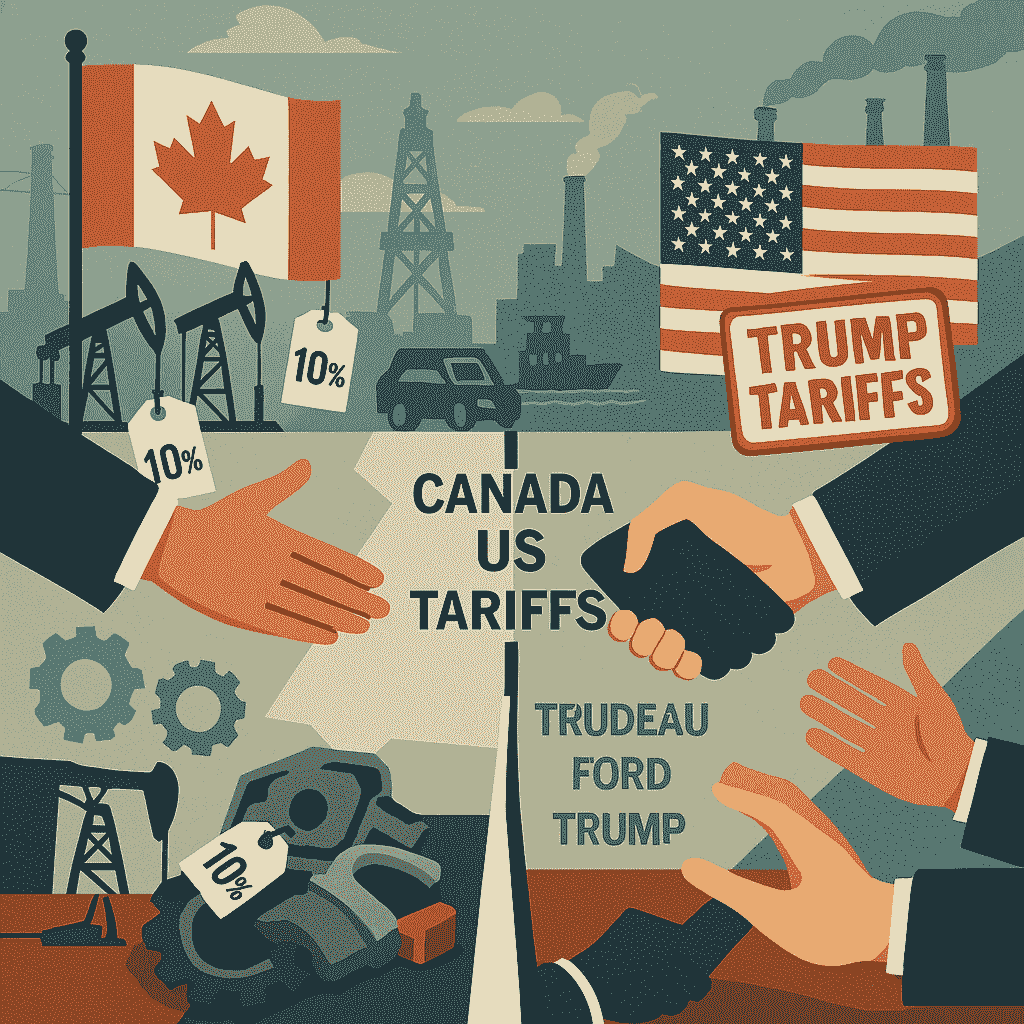

The focus will now shift to the Canadian-US tariff dispute between Trudeau, Ford Trump. Canada functions as both a physical proximity and an economic flow because it conducts $2.5 billion worth of daily commercial trade between the two nations. The New York Times reports that the 10 percent Trump tariffs impact all sectors, including petroleum products and wood products alongside automotive industries and various other industries. The prime ministerial responsibilities of Justin Trudeau demand that he maintain a delicate balance. Trudeau faces a dilemma as he decides between retaliating or negotiating with the combative Trump president because either choice presents its own political risk to Canadian voters who are dealing with economic challenges. According to The New York Times Canada has prepared another duty wave just as enormous against U.S. products following steel tariff disputes from 2018.

Doug Ford continues to fight along with his position as Ontario Premier. The manufacturing activities in Ontario support the operations of U.S. corporations, including GM. According to simple arithmetic, the ten percent duty would result in a $300 increase for each $3,000 engine, but such added taxes would undoubtedly disrupt supply chains developed through NAFTA. The Canadian prime minister faces pressure from Ford, who suggests workforce reductions and productivity decreases unless Trudeau intervenes in these trade policies. Trump displayed no flexibility during his April address because The New York Times indicates that Canada received no exemptions in what he labeled as an “unfair trade” country group.

This matters. Future talks between Trudeau and Ford, and Trump fail to produce results that could lead to an increase of thousands of dollars in car prices or force you to buy cars from different manufacturers. Tariffs demonstrate their complete economic effects through this particular situation by breaking commercial relationships while increasing financial risk to relationships along with testing stability among trading partners. The situation is ongoing because a critical economic issue continues its gradual development.

Section 6: Why Does Trump Want Tariffs—and Do They Work?

What compels President Trump to impose tariffs is the core issue. It’s about control and legacy. The borders of both China and the EU amount to $500 billion and $100 billion, respectively, in trade deficit, to which Trump has used to show how America has been victimized. Trump holds that tariffs set things right by requiring firms to purchase American products while creating American job opportunities. Trump issued this statement on April 3 through the New York Times, where he declared that his administration would restore occupations, construct new factories, and create unprecedented economic growth. This scenario represents the core idea Trump advocates for his policy because it recreates thriving steel communities where employees gain strength and the United States decides trade conditions.

Do they deliver? Evidence splits. The steel job growth created by Trump’s 2018 tariffs amounted to between 1-2 percent (the actual data indicates), yet these additional jobs came with increased production costs for automakers as well as China’s retaliatory actions. The Stock Market responded negatively to the Donald Trump tariffs, decreasing the S&P index by 4.8 percent as reported by The New York Times. The return of higher prices and export losses, and potentially a recession, emerges as investors predict these outcomes. The 34 percent countertariffs instituted by China, according to The New York Times, create fears about the situation.

The former defense minister of Japan declared in The New York Times that this situation poses a serious national emergency, yet critics predict economic slowdown and rising prices. The supporters explain that applying tariffs requires lengthy economic restructuring, which means enduring temporary hardships today for future economic advantages. The historical evidence about tariffs remains ambiguous because while the Smoot-Hawley Act in the 1930’s destroyed foreign trade, the protective tariffs of earlier decades facilitated American national strength. Trump places a massive wager on tariffs through this decision although the results remain uncertain in the future.

Conclusion

Trump’s body of tariff measures contains essential problems that affect the economy. The section defines border taxes as tariffs, then details their effects through cost increases and trade movement modifications, and their main economic result as American consumer payment. The Donald Trump tariffs stock market experiences damage and tensions between Canada US, and Trudeau and Ford and Trump continue while Trump attempts to achieve first-place status for America. Boom or bust? The stakes—jobs, prices, power—are sky-high.

What’s your view? The trump tariffs, that Trump establishes during his administration help the country or push America toward regression. All people today deal with this challenging condition as one community.

Bonus: Quick Tariffs List (April 2025)

- 10% on most imports: Canada (oil, autos), EU (wine, tech), Japan (cars), per The New York Times.

- 34% on Chinese goods: Smartphones, apparel, toys—full list TBD, per The New York Times.

- De minimis axed: Small e-commerce shipments taxed, per The New York Times.

Read More Article:- What is Forex Trading? and 1st Its Ecosystem

FAQ’s Questions,

What is a tariff, and how do Trump tariffs work?

A tariff is a tax on goods from abroad, and Trump tariffs — described in detail by The New York Times on April 4, 2025 — place a 10 percent levy on imports from most nations, and 34 percent on Chinese goods. They do this by making foreign products more expensive — such as a $20 Chinese device getting a $6.80 upcharge, costing you $26.80 — in the hopes of increasing U.S. manufacturing by making American products, let’s say, cheaper. But this rarely lowers costs for consumers and triggers retaliation, such as China’s 34 percent retaliatory tariffs.

Why does Trump want tariffs in 2025?

Trump, in his April 3 announcement reported by The New York Times, is proposing tariffs to protect American jobs and reduce trade deficits, such as the $500 billion gap with China. Trump’s hope that tariffs will revitalize industries, finance his agenda and combat “bad” trade, claiming that an “economic boom” will ensue. Critics argue that could mean trade wars and inflation — as demonstrated by the Donald Trump tariffs stock market crash of 4.8 percent.

Who pays tariffs under Trump’s new policy?

Trump tariffs are paid upfront by importers — $340 on $1,000 of Chinese goods, for example — but 80-90 percent of costs usually fall to consumers, according to The New York Times. Consumers see higher prices (grocery shoppers by late April), businesses see margins downgrade or suppliers switched, and exporters get hit by retaliation. It’s something everyone senses, from wallet to workforce.

How are Canada-US tariffs affecting Trudeau, Ford, and Trump?

According to The New York Times Canada bears tariff impacts of 10 percent on its oil exports and automotive output which damages the Canada US relationship with its leaders Trudeau and Ford Trace against Trump. Trudeau faces mounting pressure from both sides to counter the tariffs or start negotiations at the same time as Ontario Premier Doug Ford faces concerns about losing automotive employment because of increasing operational expenses such as the $300 cost increase per $3,000 engine. Trump’s refusal to make any exceptions to his trade policies puts the essential economic union between Canada and the United States to the test.

What’s the impact of Trump tariffs on the stock market?

The stock market faced immediate damage after Donald Trump increased tariffs when The New York Times reported a 4.8 percent S&P 500 decline on April 3, 2025 creating the worst drop since 2020 due to trade war anxiety among investors. The Japanese Nikkei stock exchange joined Asian markets with a 2 percent decline. Trump describes the bond market uncertainty as temporary but investors choose bonds as safe havens due to underlying economic anxieties.